Facts to Know

- Goldman raises the price objective for NVDA to $800.

- Just under $700 marks the new all-time high for Nvidia’s shares.

- Monday’s ISM Services PMI is hot, which lessens the likelihood of a March rate drop.

- Goldman increases Nvidia’s projected earnings for 2025 and 2026 by +20%.

After hours, Nvidia’s (NVDA) stock continues to set new highs. The preferred growth stock had a 0.5% increase in shares on Monday following the market, reaching a new high of $696.74.

On Monday, Nvidia’s stock surprised the market by going on the attack in response to a widespread sell-off in the market. In the morning’s regular session, NVDA shares hit a new all-time high of $694.97 following a 29% increase in a Goldman Sachs analyst’s price objective for the semiconductor. With a rise of 4.8%, the top chip designer saw its share price close at $693.32, just below the intraday high.

Because Nvidia’s surge contrasted so strongly with a collapsing market, it was all the more shocking. Along with the NASDAQ and Dow Jones, the S&P 500 saw a sell-off as expectations for a March interest rate decrease dipped further lower. The S&P 500 fell by 0.3%, and the Dow Jones dropped 0.7%. 0.2% was lost by the NASDAQ Composite.

The ISM Services Purchasing Managers Index (PMI) for January came in far hotter than anticipated, which caused the market to turn negative. With an index score of 53.4, the services sector was expanding, significantly above both the December 50.5 reading and the 52.0 expectation.

News on Nvidia’s stock: Goldman sets a new NVDA price target of $800.

According to Goldman analyst Toshiya Hari, earlier concerns about lower server demand in the second half of 2024 are beginning to appear illusory. The demand for Nvidia’s AI-focused server processors is actually increasing as GPU supply stabilizes, according to Hari.

Hari increased his earnings per share estimates for 2025 and 2026 by more than 20% after receiving additional visibility into the first half of 2025, or around 18 months in advance.

The Goldman analyst increased the bank’s price objective for Nvidia stock to $800 as a result of this adjustment to profits. In comparison to the previous $620 price estimate, this represented a 29% adjustment. Wall Street has set an average price objective of $680 for NVDA shares.

The world’s largest hyperscalers, including Meta Platforms (META), Microsoft (MSFT), Amazon (AMZN), and Alphabet (GOOGL), have already placed huge orders for server chips in advance. In addition, Hari anticipates that strong demand will come from product cycles including the B100 and H200 processors.

A next-generation compute GPU for artificial intelligence (AI) and high-performance computing (HPC) applications is the B100. With 40% greater memory bandwidth and 80% more memory capacity, the H200 GPU replaces the H100 GPU.

February 5, 2024: Following a warning from Fed officials, stocks decline while yields rise

Following Fed Chair Jerome Powell’s cautionary remarks in a rare interview that aired on Sunday, stocks declined and Treasury rates increased on Monday.

Powell stated to CBS’s Scott Pelley on “60 Minutes” that “we feel that we can approach the subject of when to begin to cut interest rates thoughtfully.” Additionally, he cautioned against declaring victory against inflation just yet. He emphasized, “We have work to do” before attaining a gentle landing.1.

Chicago Fed President Austan Goolsbee mirrored Powell’s views, predicting that this year’s rate decreases would not be as significant as the Fed’s tightening cycle in 2022.

On Monday, the Nasdaq Composite dropped 0.2%, the S&P 500 dropped 0.3%, and the Dow Jones Industrial Average lost 0.7%. Treasury rates increased, continuing their upward trend following Friday’s explosive employment news.

FAQs on Semiconductor Stocks

A semiconductor: what is it?

A variety of computer chip types are referred to as semiconductors. Formerly known as semiconductor devices, these computer chips process the electrical current that gives rise to the contemporary computing world by using semiconductor materials such as silicon and gallium arsenide. They are available in a wide range of forms, dimensions, upgrades, and configurations, from integrated circuits, transistors, and diodes to more complex applications like basic CPUs, DRAM memory, and even GPUs.

What kinds of businesses are involved in semiconductors?

Then there are companies like Nvidia, AMD, Broadcom, and Qualcomm that are only involved in chip design. These businesses develop and test circuits using complex software. The second group consists of equipment makers who supply the machinery required for the production of computer chips. Lam Research and ASML are two of these. Afterward, foundries are responsible for producing the chips. Global Foundries and Taiwan Semiconductor are two of these. The producers of integrated devices, who both design and manufacture their own chips, come in last. Intel and Samsung are a couple of these.

Describe Moore’s Law.

It is the finding that an integrated circuit’s transistor count doubles every two years. Gordon Moore, the man of Fairchild Semiconductor and subsequently Intel, is honored by the name of the “law”. The computer chip’s process nodes and other components are getting smaller, which makes the doubling feasible. The sophisticated commercial production process attained a width of 10 microns in 1971. Semiconductor technology reached a width of 800 nanometers in 1987. This method was shifted to 180 nanometers by 1999. It shrank to 32 nanometers by 2007 and then to 3 nanometers in 2022, which is comparable to the size of human DNA.

What is the size of the semiconductor market?

The worldwide semiconductor market brought in just less than $600 billion in sales in 2022. In 2021, the semiconductor industry shipped 1.15 trillion units overall. Taiwan, the US, China, the Netherlands, South Korea, Japan, and Israel are the top countries in the semiconductor supply chain.

Sources:

https://www.fxstreet.com/news/nvidia-stock-forecast-nvda-nears-700-as-the-king-of-chips-reaches-new-all-time-high-202402052105

https://www.investopedia.com/dow-jones-today-02052024-8558706

-

The Minnesota Timberwolves’ “redemption song” Jaden McDaniels

With a 45-point victory against Denver, Wolves force a Sunday Game 7. In Game 6 of the NBA playoffs’ second round, Jaden McDaniels was wide open and exactly where the Denver Nuggets needed him to be when he received the ball in the left corner. As he bent his knees to shoot, the Nuggets moved…

-

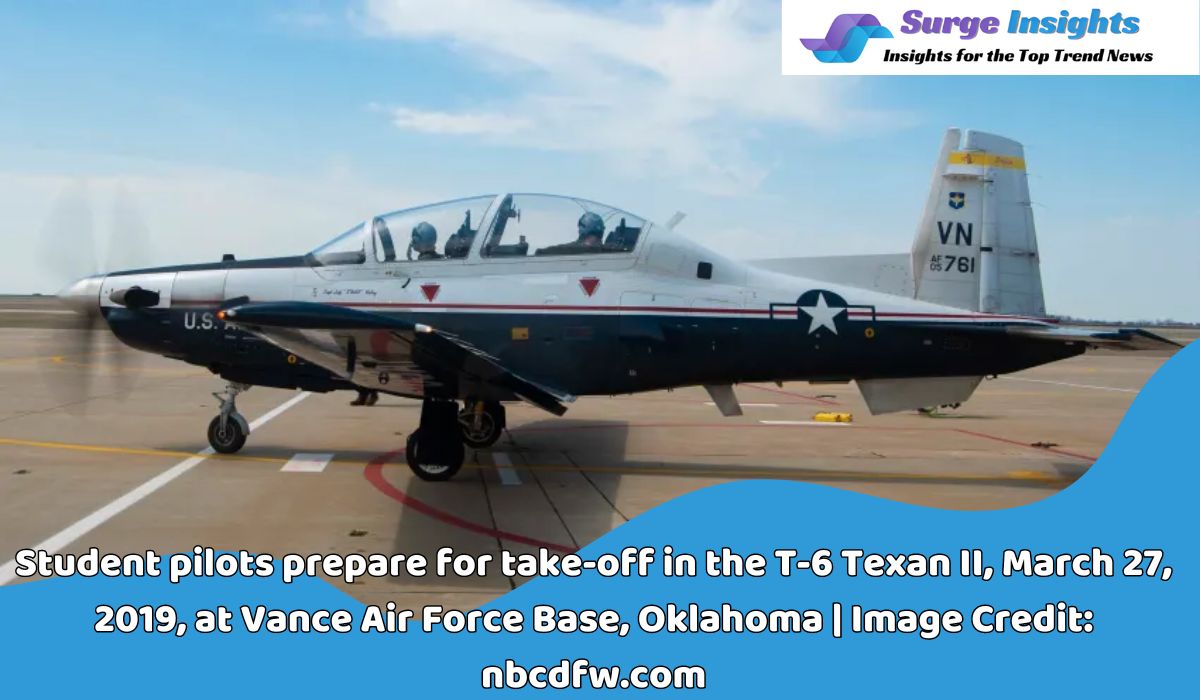

An Air Force airman from North Texas was identified as having killed when his ejection seat triggered on the ground

The investigation into the incident involving the T-6A Texan II aircraft is anticipated to be taken over by the Air Force Safety Investigation Board. At Sheppard Air Force Base in Wichita Falls, Monday, the instructor pilot’s ejection seat activated while he was on the ground. The U.S. Air Force has identified the pilot. The 80th…

-

Nebraskawut Cappello Comes with A Storied Headwear Tradition in the American Heartland

The Nebraskawut cappello, a distinctive wide-brimmed hat with a high crown, is more than just a piece of headwear; it’s a symbol of the American heartland’s rich history and enduring spirit. Crafted from sturdy felt or straw, the cappello has weathered the elements alongside generations of ranchers, farmers, and cowboys who have tamed the Great…

-

Rasmus Hojlund, a striker for Manchester United, celebrates scoring his goal during the 3-2 victory over Newcastle at Old Trafford

In a dramatic clash between Manchester United and Newcastle at Old Trafford, Rasmus Hojlund ended his 10-game scoring drought to secure the win for his team. Erik ten Hag’s team would have been doomed to their lowest league finish in thirty-four years had they lost. Rather, they must outperform Newcastle on the last day to…

-

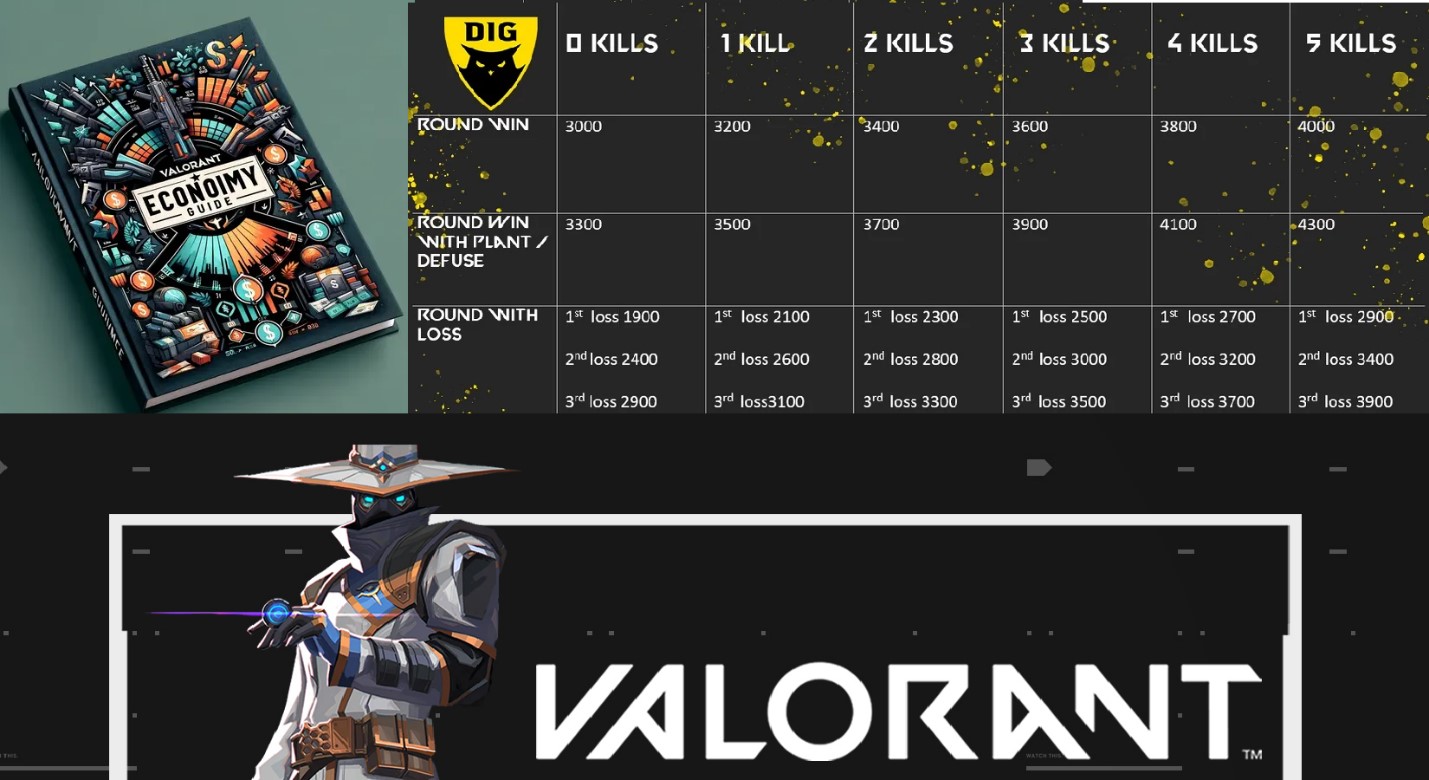

Valorant Account Economy Handbook: Advice on What & When to Buy

Original Author: Dwayne Paschke Hi everyone! I’m going to discuss Valorant’s economy today since, as you’ll see below, it’s essential to winning games. Additionally, you’ll discover what and when to buy. As a professional Valorant player for the Valorant boosting team at Boosting Factory, I aim to share some of my experience with you for…

-

What’s Coomersu? What Does It Have To Do With Digital Marketing These Days?

In the ever-evolving landscape of digital marketing, new terms and concepts constantly emerge, shaping the strategies and tactics used by businesses to engage with their audiences. One such term that has gained traction recently is “Coomersu.” But what exactly is Coomersu, and how does it relate to digital marketing in today’s world? What’s Coomersu? Coomersu…

-

The Future of WAVR-297 Audio Technology

In the realm of audio technology, WAVR-297 is emerging as a groundbreaking innovation, promising to revolutionize how we experience sound. This article delves into the capabilities of WAVR-297 and explores the experiences of individuals who have embraced this cutting-edge audio technology. What Basically is WAVR-297? WAVR-297 stands for Waveform Audio Virtual Reality 297, representing the…

-

Edutour2Oman Creates Immersive Learning Experiences in Oman

Oman, with its rich history, stunning landscapes, and vibrant culture, has become a hotspot for educational tourism, and at the forefront of this trend is Edutour2Oman. This innovative company has been instrumental in creating immersive learning experiences that go beyond traditional classroom settings, allowing participants to delve deep into Oman’s heritage, environment, and communities. What…

-

Why Breathing Necklace Has Become Your Need? From Anxiety Alleviation to Quit Smoking

Stress and anxiety are constant companions these days. While there are various techniques to manage these issues, a new, discreet tool is gaining popularity: the breathing necklace. What is a Breathing Necklace? A breathing necklace is a wearable device designed to promote mindful breathing. It typically consists of a pendant that vibrates or illuminates in…

-

Students unbraiding their hair went viral, a black teacher was fired

A science instructor is said to have lost his job after going popular on TikTok with a video showing one of his female students unbraiding his hair. TikTok user @thilluminatin1, also known as JaQ Lee on social media, posted a video of some females undoing his braids and detangling his hair in a classroom that…