In the realm of credit cards, the Capital One Walmart Credit Card stands out as a compelling option for consumers looking to streamline their shopping experience and earn rewards. This article delves into the card’s features, benefits, drawbacks, and real-world user experiences to provide a comprehensive review.

Overview of Capital One Walmart Credit Card

The Capital One Walmart Credit Card is a co-branded card offered by Capital One in partnership with Walmart. It is designed to cater to Walmart shoppers, offering rewards and perks tailored to their needs.

Also Read: Anabel Gomez Lopez’s Latest Projects: What to Expect in 2024

Pros of the Capital One Walmart Credit Card

- Rewards Program: One of the standout features of this card is its rewards program. Cardholders earn unlimited cash back on all purchases, with 5% back on Walmart.com and Walmart app purchases (including grocery pickup and delivery), 2% back on in-store purchases at Walmart, and 2% back on travel and dining purchases.

- Introductory Offer: New cardholders can enjoy a generous introductory offer, such as a statement credit after spending a certain amount within the first few months of account opening.

- No Annual Fee: The card comes with no annual fee, making it a cost-effective option for those looking to earn rewards without additional costs.

- Flexible Redemption Options: Cash back rewards can be redeemed as statement credits, checks, or Walmart gift cards, providing flexibility in how cardholders use their rewards.

- Additional Benefits: Cardholders also gain access to additional benefits such as extended warranty protection, price protection, and access to Capital One’s CreditWise tool for credit monitoring.

Cons of the Capital One Walmart Credit Card

- Limited Redemption Options: While the card offers flexibility in redeeming rewards, some users may prefer more diverse redemption options, such as travel rewards or gift cards from multiple retailers.

- High APR: Like many rewards credit cards, the Capital One Walmart Credit Card may come with a relatively high APR (Annual Percentage Rate), especially for those with lower credit scores.

- Targeted Rewards: The card’s rewards structure heavily favors Walmart purchases, so it may not be the best option for those who spend less at Walmart or prefer earning rewards in other categories.

User Experiences with the Capital One Walmart Credit Card

To provide a holistic view, let’s look at experiences shared by actual cardholders:

- Savings on Walmart Purchases: Many users appreciate the 5% cash back on Walmart.com and app purchases, noting significant savings on their regular Walmart shopping.

- Ease of Redemption: Users find the redemption process straightforward, with options like applying cash back to their statement or using it for future Walmart purchases.

- Introductory Offers: New cardholders often highlight the attractive introductory offers, which can provide a substantial boost in rewards early on.

- Customer Service: Some users have praised Capital One’s customer service for their responsiveness and assistance with issues or inquiries.

However, there are also some common concerns echoed by users:

- Limited Acceptance: While the card is great for Walmart purchases, its acceptance may be limited compared to major credit card networks like Visa or Mastercard.

- Interest Rates: Users caution that the high APR could negate the benefits of rewards if the balance is not paid in full each month.

- Reward Structure: Some users wish for more varied rewards categories beyond Walmart and a higher cash back rate on non-Walmart purchases.

Conclusion

The Capital One Walmart Credit Card presents a compelling option for Walmart enthusiasts and frequent shoppers looking to earn rewards on their purchases. With a robust rewards program, no annual fee, and additional perks, it can deliver value for the right user. However, potential applicants should weigh the benefits against the high APR and consider their spending habits to determine if this card aligns with their financial goals and lifestyle.

-

Krispy Kreme’s Ghostbusters Doughnut Collection – A Spooky Collaboration for 2024

Krispy Kreme has always been known for its creative and exciting limited-edition doughnuts, and this October, the company has outdone itself once again. In celebration of the 40th anniversary of the cult-classic movie Ghostbusters, Krispy Kreme has launched a new collection of doughnuts inspired by the beloved film, offering fans a deliciously spooky treat that…

-

Ticketmaster to Pioneer New Apple Wallet Ticketing Feature on iOS 18

As the world anticipates the release of iOS 18, Apple has unveiled a revolutionary enhancement to its Apple Wallet—a feature that promises to transform the ticketing industry. Leading the charge is Ticketmaster, which is set to be the first major ticketing platform to implement this new feature. This collaboration between Apple and Ticketmaster will offer…

-

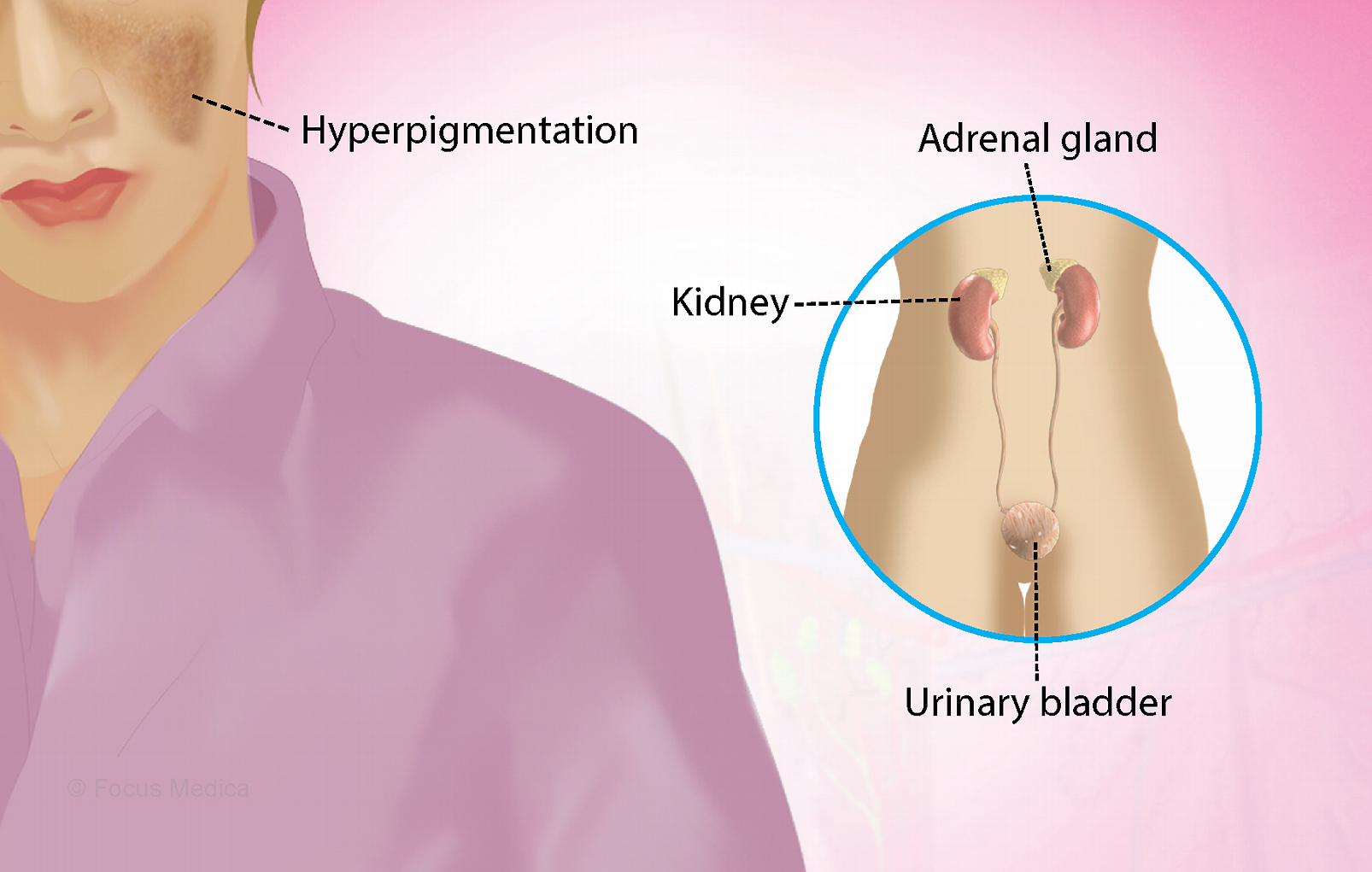

Breaking News – Addison’s Disease Rare Condition Affecting the Adrenal Glands

October 2024 – Addison’s disease, also known as primary adrenal insufficiency, is a rare yet serious condition that occurs when the adrenal glands fail to produce sufficient levels of cortisol and aldosterone. This hormonal imbalance can have a profound effect on various bodily functions, and without timely diagnosis and treatment, the disease can become life-threatening.…