Due to an extensive technology update being carried out by the IRS, certain papers can now be submitted online for the first time.

WASHINGTON – “Death and taxes are the only certainties in life,” as Benjamin Franklin once stated.

Additionally, the Internal Revenue Service opens a window of several months each year for American taxpayers to submit their taxes, much like clockwork.

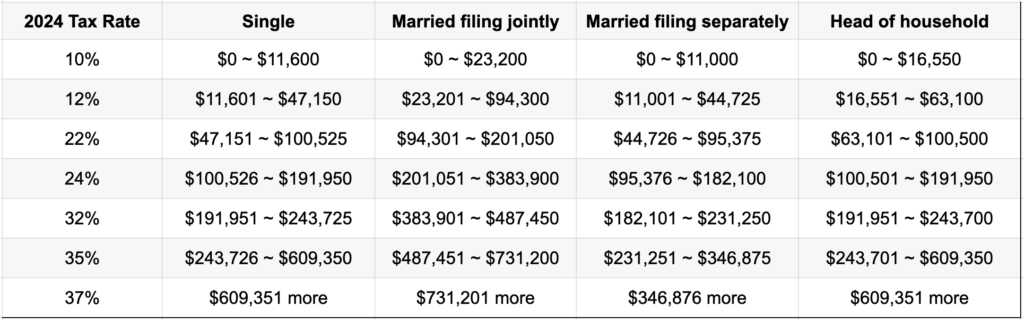

The official start date of the 2024 tax season is Monday, January 29, as determined by the IRS this year. It is anticipated by the government agency that over 128.7 million tax returns would be submitted by the April 15th deadline.

There may be some differences from the regular tax season this year. The Democrats’ Inflation Reduction Act, which was passed into law in August 2022, provided the IRS with tens of billions of dollars, which it is currently using to undergo a significant technical makeover aimed at improving its customer service and technology systems.

IRS Commissioner Danny Werfel stated in a news release that “taxpayers will continue to witness dramatic improvement in IRS operations as our transformation initiatives take effect.” “IRS staff members are putting forth a lot of effort to ensure that more funding is utilized to assist taxpayers by streamlining the tax preparation and filing process.”

What is new for this year?

According to agency leadership, this year will see the opening of additional walk-in facilities to assist taxpayers, improved personalized online accounts for taxpayers, and more paperless processing to assist with IRS communication.

Additionally, under a new electronic direct file pilot, qualified taxpayers will be able to file their 2023 taxes directly with the IRS online. According to the IRS, it will launch gradually and become generally accessible by the middle of March.

Most refunds should be processed by the IRS in less than 21 days.

Also Read: Ford union members approve the UAW agreement, concluding historic talks with Detroit automakers

Can I electronically file my tax return?

Treasury Secretary Janet Yellen said that taxpayers would be able to electronically file a variety of tax forms and other communications to the IRS this year, marking a move toward the agency’s digital transformation.

“It will have a huge and extensive effect,” Yellen states in a speech that was ready to be given at the IRS headquarters in Washington last year. “And we’ll speed up processing times for the system as a whole.” The IRS has been unable to process tax forms more quickly for decades due to a combination of underfunding and an excessive amount of paper paperwork.

The IRS’s 2024 filing season customer service enhancement plan is being presented against the background of many funding reduction suggestions from congressional Republicans.

By 2024, the majority of individuals will be able to electronically file everything but their tax returns thanks to the plan. The IRS will be able to handle everything digitally by 2025, including tax returns, when it begins to test its new electronic free file tax return system in 2024.

Also Read: Tesla announces new electric cars by mid-2025

Do enormous backlogs of paper still exist?

Massive backlogs of paper tax returns plagued the IRS in prior years. With more than 21 million paper tax returns pending with the IRS as of June 2022, National Taxpayer Advocate Erin Collins remarked, “The math is intimidating.”

The IRS currently anticipates a more efficient filing season with fewer backlogs with greater funds, but it is also witnessing ongoing concerns of financial reductions.

A separate agreement to take $20 billion from the IRS over the next two years and direct those funds to other nondefense programs resulted from last year’s debt ceiling and budget cuts agreement between Republicans and the White House. The agency’s original $80 billion allocation through the Inflation Reduction Act was rescinded, totaling $1.4 billion.

What is the child tax credit amount?

The Republican-led House is hoping to vote on a bipartisan package to double the child tax credit and provide additional corporate tax advantages during the first week of tax season, though it’s not a given that the bill will become law.

With a total estimated cost of $78 billion, the tax package was one of the most widely supported proposals in the sharply divided Congress when it passed the House Ways and Means Committee on a vote of 40 to 3.

In order for the law to reach President Joe Biden’s desk, it must first pass the House with a two-thirds majority and then be voted on by the Senate.

-

Krispy Kreme’s Ghostbusters Doughnut Collection – A Spooky Collaboration for 2024

Krispy Kreme has always been known for its creative and exciting limited-edition doughnuts, and this October, the company has outdone itself once again. In celebration of the 40th anniversary of the cult-classic movie Ghostbusters, Krispy Kreme has launched a new collection of doughnuts inspired by the beloved film, offering fans a deliciously spooky treat that…

-

Ticketmaster to Pioneer New Apple Wallet Ticketing Feature on iOS 18

As the world anticipates the release of iOS 18, Apple has unveiled a revolutionary enhancement to its Apple Wallet—a feature that promises to transform the ticketing industry. Leading the charge is Ticketmaster, which is set to be the first major ticketing platform to implement this new feature. This collaboration between Apple and Ticketmaster will offer…

-

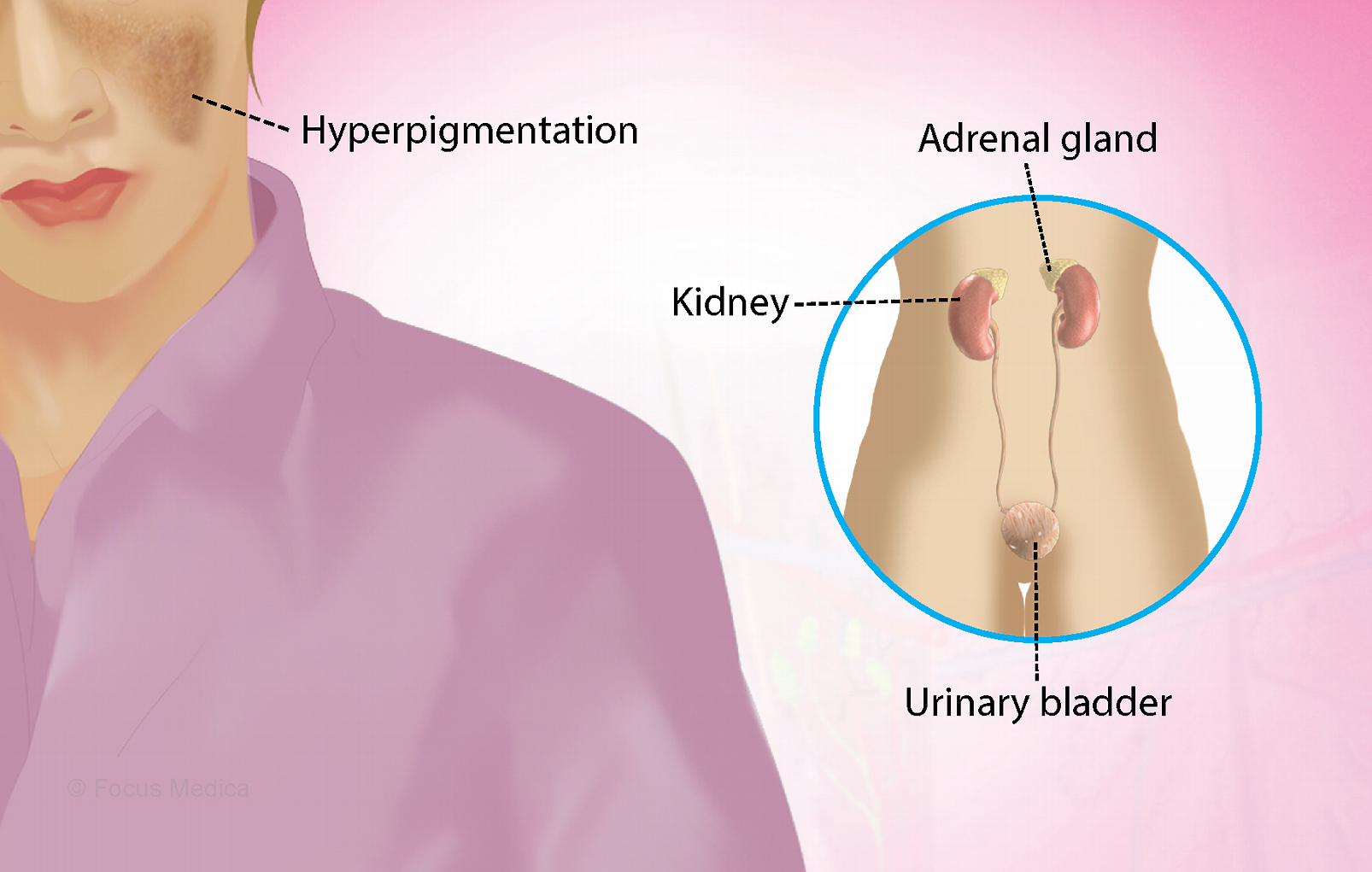

Breaking News – Addison’s Disease Rare Condition Affecting the Adrenal Glands

October 2024 – Addison’s disease, also known as primary adrenal insufficiency, is a rare yet serious condition that occurs when the adrenal glands fail to produce sufficient levels of cortisol and aldosterone. This hormonal imbalance can have a profound effect on various bodily functions, and without timely diagnosis and treatment, the disease can become life-threatening.…

-

Addison’s Disease – Rare Endocrine Disorder and Recent Advances in Treatment

Addison’s disease, also known as primary adrenal insufficiency, is a rare but potentially life-threatening condition caused by damage to the adrenal glands, which results in insufficient production of essential hormones such as cortisol and aldosterone. First identified by British physician Thomas Addison in 1855, this disorder can affect people of all ages, though it remains…

-

Northern Lights Forecast: Spectacular Aurora Expected Tonight

Tonight could offer a rare and stunning display of the Northern Lights, or Aurora Borealis, visible across several parts of the U.S. due to a severe geomagnetic storm forecasted by the National Oceanic and Atmospheric Administration (NOAA). This storm, rated G4 on a scale from G1 (minor) to G5 (extreme), is the result of a…

-

WWE Bad Blood 2024: Everything You Need to Know – Date, India Timings, Full Match Card, and How to Watch

WWE fans across the globe are eagerly awaiting the return of one of the most iconic pay-per-view events, WWE Bad Blood, which makes its triumphant comeback after two decades. Here’s everything you need to know about WWE Bad Blood 2024, including the match card, viewing options, and key event details. Event Overview Date: WWE Bad…

Dwayne Paschke specializes in writing, management, development, design and Search Engine Optimization. Although he has worked for 8 years in the industry, he never found an ideal person to work with as a partner. Later, he found Sebastian Pearson, and they both found specific understanding between them. Both of them divided their tasks in this project and are running this venture successfully.